Earlier this year, Serba Dinamik’s auditor KPMG had raised issues regarding the company’s sales transactions, trade receivables and payables, as well as material on-site balances. The issues raised involved 11 parties which accounted for total sales transactions of RM2.32 billion, trade receivables balance of RM652 million and materials on site balance of RM569 million. Since then, the share price of the company had dropped all the way down from RM1.6 to RM0.35 and has been suspended from trading since October 22.

However, that didn’t free Serba Dinamik from further troubles such as preventing the release of a special independent review (SIR), failing to release their annual report, endless changes in the board room, and missing coupon payments, just to name a few. Currently, they are seeking legal recourse against Bursa Malaysia, EY and its original auditors KPMG.

Even though I’m definitely sceptical about Serba Dinamik’s innocence, I’m not here to judge who’s right and wrong, since the damage to all the retail investors’ wealth had already been done (including 52% of my invested capital). Instead, I’m trying to learn from my mistake of investing in Serba Dinamik by studying their annual reports from 2013 to 2021.

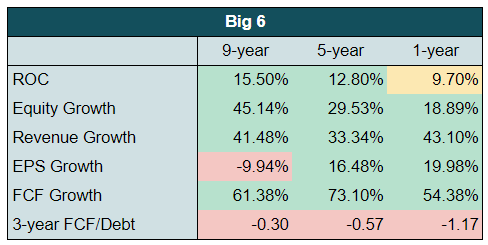

The Big 6

Let’s start by analyzing the 6 most important things to identify a great business, credit to Rule #1 by Phil Town. (It’s originally The Big 5, but I modified it a bit.)

At first sight, this seems like a rare gem that almost checks all the boxes. Some of the companies that I found so many greens are monopolies like $GOOG, $FB and $MSFT. However, a closer look will prove otherwise. For one, the seemingly high free cash flow growth is actually growing over 50% in the negative direction. In hindsight, below are all the issues that I could’ve found in their financial statements, without looking into their allegedly questionable business practices, but just the numbers.

Dilution

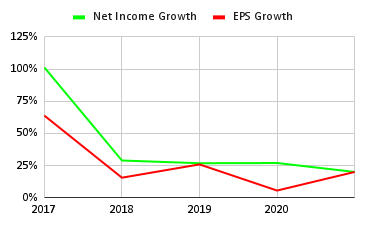

5-year net income CAGR: 25.6%

5-year earnings per share CAGR: 16.5%

Even though the company had a really impressive net income 5-year CAGR of over 30%, its EPS growth rates were almost always lower than its net income growth rate, and in some years was just half of that of its earnings. Don’t get me wrong, 16% CAGR is in no way weak growth, but this should be the first red flag that the company is diluting its shareholders since the earnings had to be divided into more and more shares.

From the income statements, they actually grew the shares outstanding from 2.7 billion in 2017 to 3.7 billion in 2021, with a CAGR of 7.8%. This is actually not that bad, considering high-growth companies usually need more cash to fund their operations. For comparison, $TSLA diluted their shareholders by 10.7% annually from 2017 to 2020.

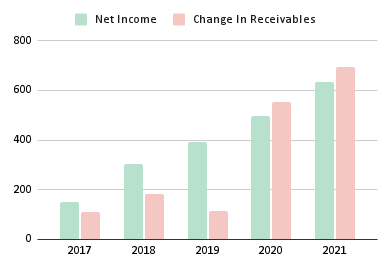

Receivables

Receivables are debts owed to a company by its customers for goods or services that have been delivered or used but not yet paid for. Receivables are recorded as revenue at the time of a sale when a good or service has been delivered but not yet been paid for.

In the case of Serba Dinamik, their receivables were growing strongly along with their revenue and earnings, and in recent years, the receivables generated in a single year were even higher than the net income of the year. If they failed to collect the payments from their customers, it would risk wiping out all the net income.

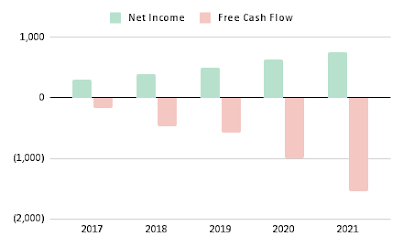

Free Cash Flow

Free cash flow is the real profit generated for the owners, while net income is just the money made on the income statement. Therefore, it is said that buying a company is buying the future cash flow of the company. In a good company, free cash flow and net income generated should be heading in the same direction in the long run, even though there might be some one-time events that hurt the free cash flow. For Serba Dinamik, the two were both growing consistently, in a completely different directions. By running a company like this, you can achieve good growth on the earnings reports but will never see the money coming into your pocket (unless you are a genius and do the following trick).

Fund Raising

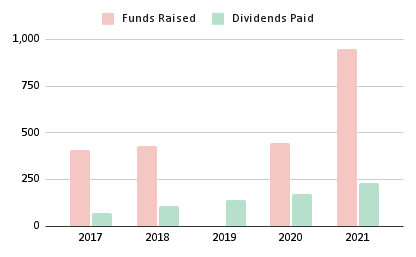

From 2017 to 2021, the company raised around RM2.2 billion from its investors by issuing new shares. However, the company had also been increasing the dividends paid to their shareholders, at a stunning rate of 35%. For a company that failed to generate free cash flow every year, they sure were generous with their dividends. This essentially means that they were getting cash from their investors, just to give a part out as dividends. In the end, the management was the people who benefited from the multiple fund-raisings by pocketing their huge sum of dividends.

Conclusion

金玉其外,败絮其中 is a Chinese idiom which means something that is looking good on the outside but is a mess on the inside.

The top-line and bottom-line growth alone can’t give the full picture of how well a company is doing, but what is on the headline is always revenue and income. Always look for red flags in a company’s financial statements. Don’t be a sheep.