How much would you pay for two large pizzas? 5,000 yen? 10,000 yen?

How about $300 million?

About 12 years ago, a Florida man Laszlo Hanyecz purchased a pair of Papa John’s pizzas using 10,000 Bitcoins, which equated to roughly $41 back in 2010. He didn’t get himself a bargain as the pizzas would have cost $25 had he paid in cash, but at least he and his family had a great evening, and hopefully some leftovers.

However, just nine months later, the deal seemed even worse when Bitcoin reached 1:1 with the US dollar making the two pizzas worth $10,000. Today, those 10,000 Bitcoins would be valued at around $300 million. This was the first commercial Bitcoin transaction, and it is for this reason that May 22nd is designated as Bitcoin Pizza Day (1). So, what is Bitcoin?

It seems like a simple question, but you will get a variety of answers. The anti-Bitcoin will say that Bitcoin is a hoax and has no real value as its price fell more than 60% from its peak (2), while the pro-Bitcoin will respond that if you live in a country like Turkey you lost 50% in a year regardless (3). The Bitcoin haters will tell you that it is a currency for criminals as $14 billion of cryptocurrencies were being used in crimes in 2021 (4), while the Bitcoin holders will argue that there must be way more crimes involving cash. The news will say that Bitcoin is the worst creation ever because it consumes more electricity than countries like UAE, Argentina and the Netherlands (5), while the Bitcoin blogs will show you the research that claims that the banking system uses more than double the energy of Bitcoin (6).

The truth is, no matter which side you are on, you can always find a piece of data that fits your narratives, and tell the story you want to tell. I am not here to convince you that Bitcoin is good or evil, or whether you should invest in Bitcoin or not. Instead, as an engineering student who loves learning new things and a small investor who has been dabbling in all sorts of investment vehicles, I am here to share some of my findings on Bitcoin, and why I think that Bitcoin is a better form of money than the currencies we are using today.

What makes a good currency?

Have you ever wondered why we use the Japanese Yen to pay for goods and services instead of using apples?

First of all, the Japanese Yen is the official currency issued by the Japanese government and we are in Japan right now, so everybody is using Yen. That’s obvious. We receive payments in Yen because we know that someone else will accept it as payment whenever we need to buy something. If someone tries to pay you with apples, you probably think that they are crazy. Next, we don’t use apples as money because eventually they’ll spoil, while the banknotes and coins are durable and can keep their value for a long time. It’s difficult to purchase something, say a candy, that is worth a fraction of an apple. In comparison, we can technically buy something that is as cheap as just 1 Yen. Of course, it’s also way easier to pay with cash than carrying bags of apples around. Finally, it’s scarce as no one can print more money freely (except for the government), but anyone with a backyard can always plant more apple trees and destroy the value of apples for everyone.

In short, I would say that a useful currency should have these five attributes: acceptability, durability, divisibility, portability and scarcity (8).

What is Bitcoin? (9)

Now back to the question of what is Bitcoin. Bitcoin is a decentralized digital currency, or cryptocurrency, invented in 2008 by an unknown person or group by the name of Satoshi Nakamoto. “Decentralized” means that Bitcoin operates free of any central control or the oversight of banks or governments, and it can be sent from user to user on the Bitcoin network without the need for intermediaries, or middlemen. There is a public ledger that records all Bitcoin transactions and the copies are held on servers, also known as nodes, around the world. Every 10 minutes, new transactions will be updated on the ledger, and consensus on who owns how many Bitcoins is reached across these nodes rather than relying on a central source of trust like a bank.

Let’s say I send you 0.001 Bitcoin and regret it afterward. If I try to hack into your computer and delete the transaction on your ledger, it isn’t going to work, because all the other ledgers are saying a different thing. I won’t be getting back my money unless you send it back. This makes it practically impossible to alter the figures on the ledgers because you need to control the majority of all of the nodes to do so. The more the people that use Bitcoin, the more nodes there will be, and the harder it is for any party to tamper with the ledger.

This is the core concept of Bitcoin, a decentralized digital currency. I’m not going to bore you with the technicality of how Bitcoin works, with all the buzzwords like “cryptography”, “blockchain” and “mining”. You really don’t need to understand everything about Bitcoin in order to use it, like how most of us couldn’t describe how the internet works but still use it every single day. Instead, let’s take a look at some of the properties of Bitcoin to see how Bitcoin stands against other currencies in the world.

The properties of Bitcoin

First of all, is Bitcoin widely accepted? We can send any amount of Bitcoin to anyone in any country at any time, provided the person has a Bitcoin address. Unlike the traditional banking system, it doesn’t matter which country you are from, how old you are, or how much money you make, you can have a Bitcoin address with just a few clicks. Bitcoin does not discriminate. Here are some of the names you might have heard of that accept Bitcoin. You can pay for games and apps in the Windows and Xbox stores ever since 2014. Or you can donate to Wikipedia using Bitcoin. I am sure some of you have been to or at least heard of this huge electronics chain called Bic Camera. You can actually pay with Bitcoin there too! (12)

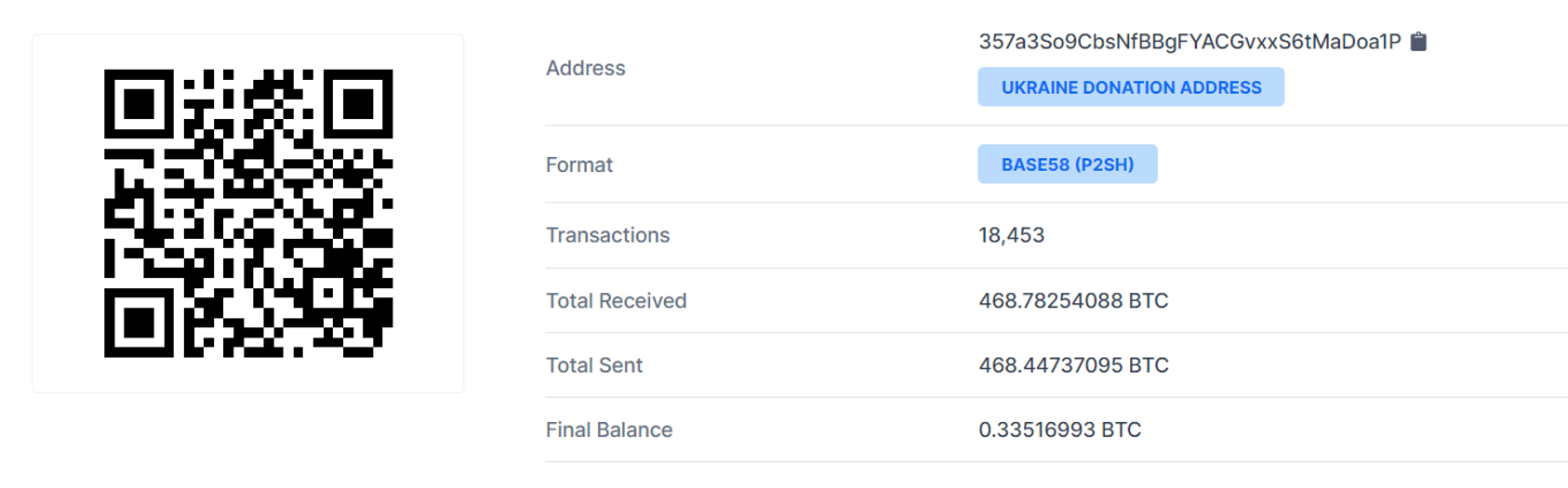

Another great example of the acceptability of Bitcoin can be seen when the Ukrainian government tweeted the pleas for donations in Bitcoin and other cryptocurrencies (13). To date, the two addresses have received donations worth more than $30 million (14) (15).

It’s especially convenient for people that need to make international transfers. With the bank I’m currently using in Japan, I’ll need to pay a transfer fee of 3,000 to 7,500 Yen, and wait for two to seven business days for the transfer to go through (10). Not to mention the money lost through their terrible conversion rate and the hassle to fill in all the required details. With Bitcoin, all I need is the recipient’s Bitcoin address, around $2 in fees and an hour at most.

Bitcoin is also divisible. The smallest unit of Bitcoin is called Satoshi, which represents a hundred millionth of a Bitcoin. Obviously, it is named after Satoshi Nakamoto, the creator of Bitcoin. Most currencies can only be divided into two decimal places like the US Dollar, or can’t be divided at all like the Japanese Yen.

Is Bitcoin durable? Bitcoin is just lines of codes stored in thousands of computers, so of course it’s durable. In the case of a global internet shutdown, which is extremely unlikely, the computers will stop communicating with each other but the halt would not affect the content of the ledgers. Once the internet is back, the computers will verify the copies, like they always do.

Is Bitcoin portable? Yes and no. No, you can’t carry a physical Bitcoin around. Yes, you can send or receive Bitcoin on your phone just like how you use a digital wallet, scan-and-pay. If you are comfortable doing cashless payments with apps like PayPay and LinePay, Bitcoin wouldn’t be a problem for you.

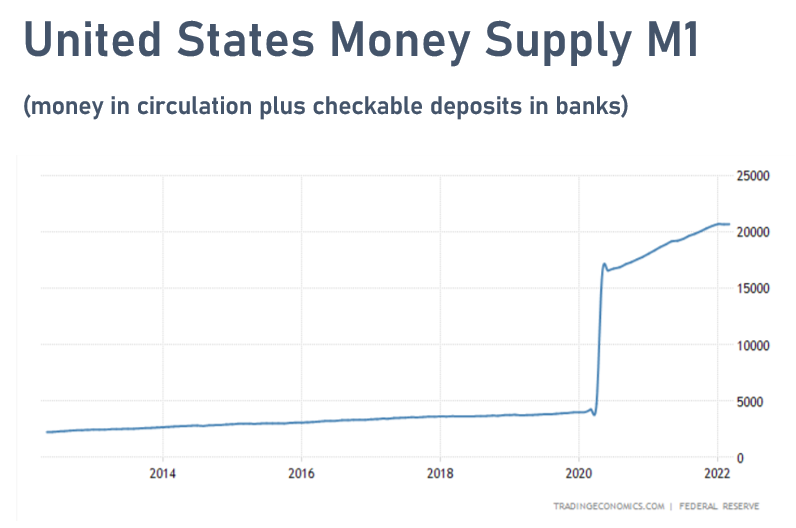

How about the scarcity of Bitcoin? When Satoshi Nakamoto created Bitcoin, he wrote in the source code that only 21 million Bitcoins will ever be produced. There are 19 million Bitcoins in existence now, and more will be created in a predetermined manner until the last one is created in 2140. This is arguably the biggest difference between Bitcoin and our traditional currencies. Currencies supplied by central governments do not have limits, which means governments are free to print more whenever they need. Look at this graph by the Federal Reserve (16) and you’ll realize how much the money supply had surged in the past two years. This is said to be one of the reasons why we are now seeing the highest inflation rate in the United States in 40 years (17).

Conclusion

So, I painted Bitcoin as the perfect currency, the future of finance, the magical coin that will make you filthy rich. Does that mean you should put all your money into Bitcoin and wait for the price to rise until you become a millionaire? It’s true that Bitcoin exhibits a lot of the traits a good currency should have. It’s widely accepted, durable, divisible, portable, and scarce.

However, there have been equal, if not more criticisms of Bitcoin, including the insane volatility of price, the long transaction time, the enormous energy consumption to maintain the network, the usage in criminal activities, and the crackdown by the governments, just to name a few. These are all legitimate concerns you should have if you decided that you want to own Bitcoin. I’ve done my research and only put in a small amount of money that I’m comfortable losing. I certainly don’t expect the price to increase 100-fold like how it did back then.

Lastly, I want to make it clear that this is not financial advice and you should always do your own due diligence before making any investment. Thank you for listening.

(Note: This is a speech I wrote and presented for my English class.)

Reference

- https://nypost.com/2021/05/24/bitcoin-pizza-guy-who-squandered-365m-has-no-regrets/

- https://www.tradingview.com/chart/5zcquOfR/?symbol=FX_IDC%3ATRYUSD

- https://www.tradingview.com/chart/5zcquOfR/?symbol=FX_IDC%3ATRYUSD

- https://blog.chainalysis.com/reports/2022-crypto-crime-report-introduction/

- https://ccaf.io/cbeci/index/comparisons

- https://www.lopp.net/pdf/On_Bitcoin_Energy_Consumption.pdf

- https://www.investopedia.com/articles/07/roots_of_money.asp

- https://www.investopedia.com/ask/answers/100314/why-do-bitcoins-have-value.asp

- https://bitcoin.org/en/

- https://www.jp-bank.japanpost.jp/kojin/sokin/kokusou/kj_sk_ks_koza.html

- https://smallbiztrends.com/2021/12/who-accepts-bitcoin.html

- https://matsunosuke.jp/biccamera-bitcoin/

- https://twitter.com/Ukraine/status/1497594592438497282

- https://www.blockchain.com/btc/address/357a3So9CbsNfBBgFYACGvxxS6tMaDoa1P

- https://www.blockchain.com/eth/address/0x165CD37b4C644C2921454429E7F9358d18A45e14

- https://tradingeconomics.com/united-states/money-supply-m1

- https://tradingeconomics.com/united-states/inflation-cpi